The Rise of Low Cost Prop Firms: Transforming the Financial Landscape

Understanding Prop Firms

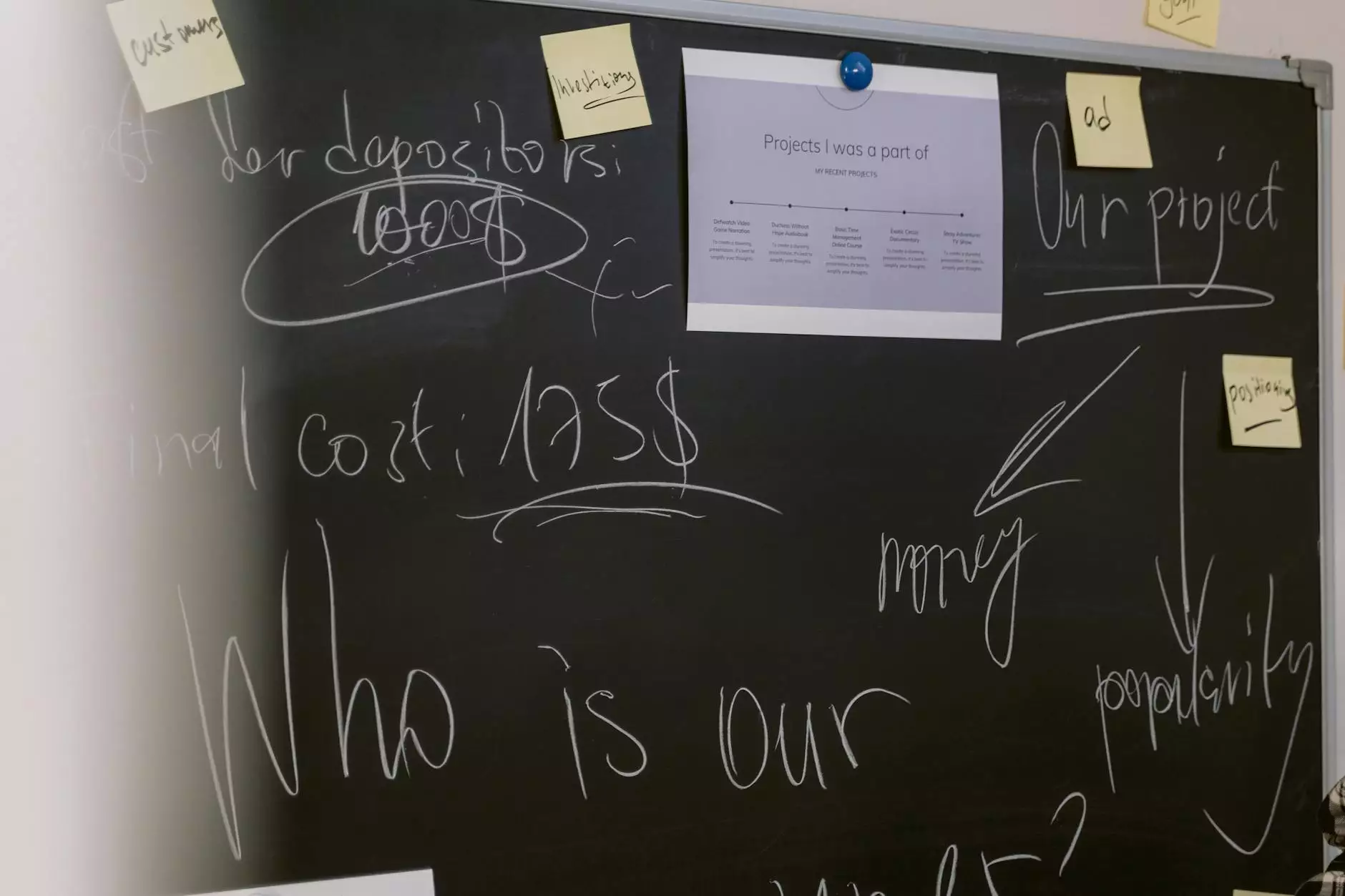

Proprietary trading firms (prop firms) have emerged as a significant player in the trading arena, allowing traders to engage in trading using the firm's capital. Typically, traders in these firms share a portion of their profits with the firm while benefiting from their resources and support. In recent years, the concept of low cost prop firms has gained momentum, attracting a broader range of traders—from novices to seasoned veterans—by significantly lowering barriers to entry.

The Appeal of Low Cost Prop Firms

With the trading industry constantly evolving, the emergence of low cost prop firms has revolutionized how individuals approach trading. Here are several compelling reasons why these firms have become increasingly appealing:

- Lower Financial Barriers: Aspiring traders can now access capital without needing significant personal investment.

- User-Friendly Platforms: Most low cost prop firms offer easy-to-use trading platforms equipped with powerful tools.

- Professional Mentorship: Many firms provide mentoring and educational resources to enhance traders' skills, making them more competitive.

- Flexible Trading Strategies: Traders have the freedom to employ various strategies without the constraints of standardized trading guidelines.

Advantages of Trading with Low Cost Prop Firms

Engaging with low cost prop firms offers numerous benefits that can significantly enhance a trader’s potential for success:

1. Access to Substantial Capital

One of the most significant advantages of joining a low cost prop firm is the opportunity to trade large amounts of capital. This access allows traders to execute larger trades and manage bigger positions, which can lead to higher profits.

2. Risk Management Support

Many firms offer risk management tools and strategies, which promote safer trading practices. Traders are trained to manage risk effectively, minimizing potential losses and maximizing potential gains.

3. Networking Opportunities

Working within a prop firm allows traders to connect with like-minded individuals and industry professionals, fostering an environment of collaboration and growth.

4. Cutting-Edge Technology

Low cost prop firms invest in top-tier technology, providing traders with advanced trading platforms, analytical tools, and market insights. This technological edge can be a game-changer in achieving trading success.

How to Choose the Right Low Cost Prop Firm

With an increasing number of low cost prop firms available, selecting the right one can be daunting. Here are some critical factors to consider:

- Reputation: Research the firm’s reputation within the trading community. Look for reviews, testimonials, and success stories.

- Fee Structure: Understand the commission and fee structure. Ensure it aligns with your trading style and expectations.

- Support Services: Evaluate the training and mentorship services offered by the firm.

- Withdrawal Policies: Review the firm's withdrawal policies to ensure you can obtain your profits easily.

Top Strategies for Success in Low Cost Prop Firms

Being successful in a low cost prop firm requires discipline and strategic thinking. Here are some proven strategies that can help traders thrive:

1. Develop a Robust Trading Plan

A well-defined trading plan is crucial. Establish clear goals, risk tolerance, and trading strategies that you are comfortable with. Review and adjust your plan regularly based on performance and market conditions.

2. Continuous Education

Utilize the educational resources that prop firms provide. Continuous learning will enhance your skills and understanding of market dynamics, making you a more effective trader.

3. Risk Management is Key

Implement strict risk management protocols including setting stop-loss orders and ensuring that you only risk a small percentage of your capital on any single trade.

4. Stay Informed

Keep abreast of market news, economic indicators, and geopolitical events that might affect trading conditions. This knowledge will give you an advantage in decision-making.

Challenges to Anticipate with Low Cost Prop Firms

While the benefits are significant, there are some challenges associated with low cost prop firms:

- High Competition: Traders face stiff competition from their peers to outperform one another and secure profits.

- Pressure to Perform: The pressure of managing other people's capital can lead to stress and potentially hinder decision-making.

- Lack of Personalization: As firms cater to many traders, some services and support may feel less personalized and more standardized.

Conclusion: The Future of Trading with Low Cost Prop Firms

In conclusion, low cost prop firms provide an excellent avenue for individuals looking to dive into the trading world without the burdensome costs usually associated with trading. As the industry continues to develop and adapt to technological advancements and market changes, these firms are likely to become a central pillar in the financial services landscape.

By leveraging the capital, resources, and knowledge brokered by these firms, traders can refine their skills, enhance their trading strategies, and ultimately pave their way toward success in the dynamic world of trading. As the barrier for entry lowers, the potential for successful trading careers grows, making these firms a viable and attractive option for many.